As parents, we want to give our children every advantage in life—and one of the most valuable gifts we can offer is financial literacy. Teaching budgeting skills to tweens (ages 9-12) isn’t just about managing pocket money; it’s about building the foundation for a lifetime of financial confidence and breaking the cycle of living paycheck to paycheck.

The tween years present a unique opportunity. Your child is old enough to understand basic money concepts but young enough to develop healthy habits before peer pressure and teenage impulses take hold. By starting now, you’re not just teaching budgeting—you’re empowering your child with skills that will serve them well into adulthood.

"Give a child a dollar, and they'll spend it in a day.

Teach a child to budget, and they'll build wealth that stays.

For in these tender tween years, when habits take their hold,

We plant the seeds of wisdom worth more than finest gold."

Table of Contents

Why Start Budgeting Education with Tweens?

Tweens are naturally curious about how the adult world works, including money. They’re beginning to understand that money is finite, that choices have consequences, and that planning ahead matters. This developmental stage makes it the perfect time to introduce budgeting concepts in fun, engaging ways that stick.

Research shows that financial habits formed in childhood often persist into adulthood. By teaching your tween to budget now, you’re helping them avoid the stress and limitations that come with poor financial management later in life.

The Foundation: Introducing the 3-Bucket System

The most effective way to teach budgeting to tweens is through the simple, visual 3-bucket system. This approach divides money into three clear categories that even young minds can grasp:

Spend Bucket (50%): This covers immediate wants and small purchases like snacks, toys, games, or treats. It teaches tweens that spending money is okay when it’s planned and controlled.

Save Bucket (40%): Reserved for bigger goals that require patience and planning—perhaps a new bike, gaming system, or special trip. This bucket teaches delayed gratification and goal-setting.

Give Bucket (10%): Dedicated to charity, school fundraisers, or causes your tween cares about. This cultivates empathy and demonstrates that money can be a tool for helping others.

The beauty of this system lies in its simplicity and visual nature. Whether you use actual jars, envelopes, or separate savings accounts, tweens can literally see their money growing in each category. This tangible approach makes abstract budgeting concepts concrete and manageable.

Smart Allowance Strategies That Teach Real-World Skills

Allowances serve as an excellent budgeting laboratory. The general rule of thumb suggests $1-2 per year of age, putting most tweens in the $10-20 weekly range. However, the amount matters less than how you structure it.

Instead of simply handing over money, consider linking allowances to responsibilities or effort. This doesn’t mean paying for every household chore—family members should contribute simply because they’re part of the household. Rather, tie allowance to age-appropriate responsibilities that teach the connection between work and income.

This approach mirrors real-world employment while keeping expectations reasonable. Your tween learns that money comes from effort and responsibility, not simply from existing.

Setting and Achieving Savings Goals Together

Goal-setting transforms saving from an abstract concept into an exciting challenge. Work with your tween to establish both short-term goals (3 months, like saving $50 for a video game) and long-term goals (6-12 months, such as $200 for a bicycle).

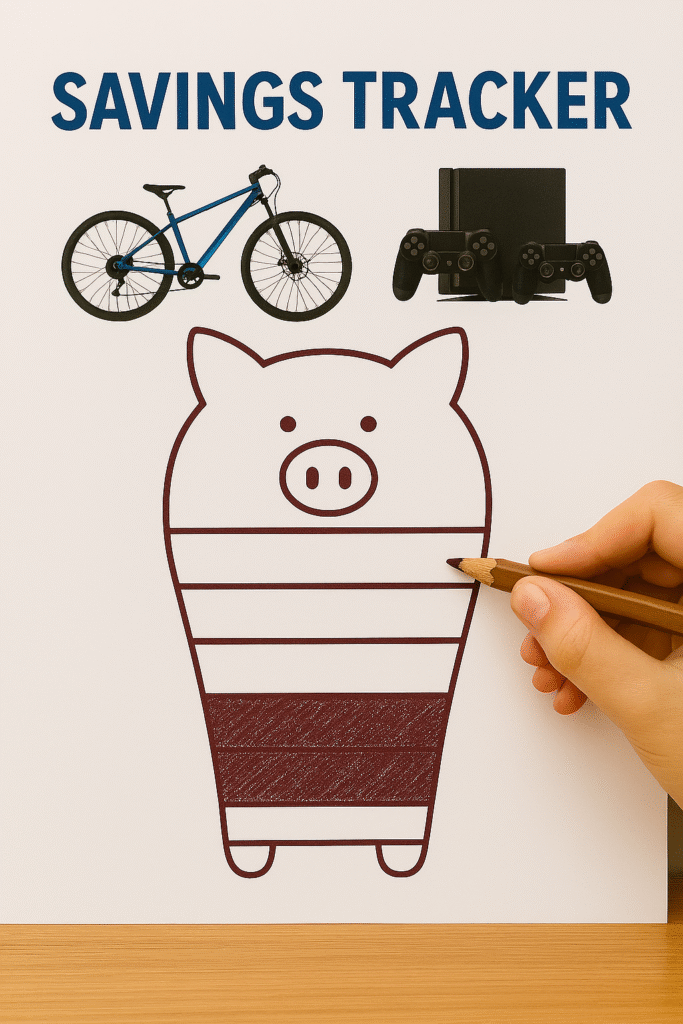

Visual progress tracking proves incredibly motivating for tweens. Whether using a colorful chart, a clear jar where they can watch money accumulate, or a kid-friendly app that shows progress digitally, seeing advancement toward their goal maintains momentum during moments when spending seems more appealing than saving.

Break larger goals into smaller milestones. If your tween wants to save $200 for a bike, celebrate when they reach $50, $100, and $150. These intermediate victories keep motivation high and make the final goal feel achievable rather than impossibly distant.

Technology Tools: Kid-Friendly Budgeting Apps

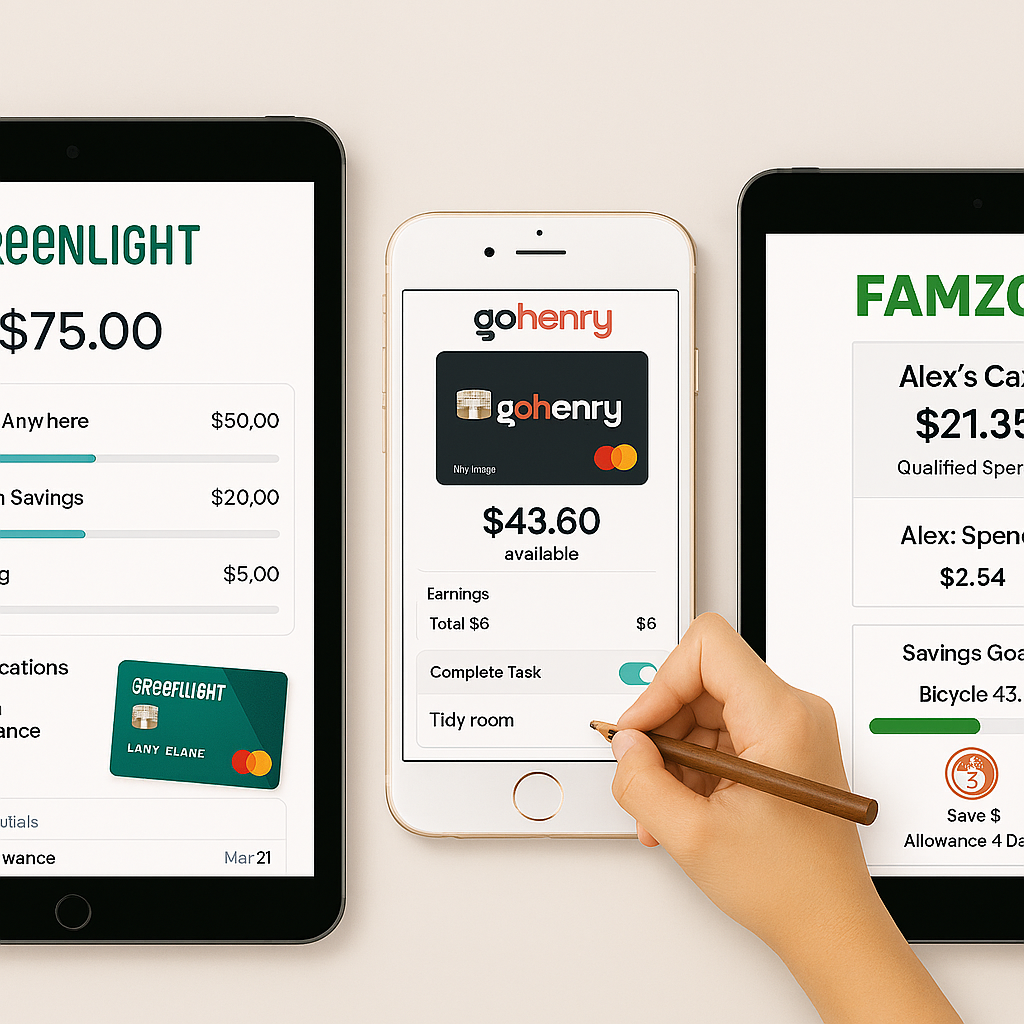

Today’s tweens are digital natives, making financial apps natural learning tools. Platforms like Greenlight, GoHenry, and FamZoo offer virtual debit cards with parental controls and real-time budgeting features designed specifically for young users.

These apps provide several advantages: they show real-time balances, categorize spending automatically, and allow parents to monitor progress without being overly intrusive. Many tweens find managing money digitally more engaging than physical cash, and these platforms bridge the gap between childhood money lessons and adult financial tools.

However, don’t rely entirely on apps. Combining digital tools with physical money experiences ensures tweens understand that digital transactions represent real money, not unlimited resources.

Teaching Needs vs. Wants Through Hands-On Activities

The distinction between needs and wants forms the cornerstone of smart budgeting, but it’s often challenging for tweens to grasp in abstract terms. Hands-on activities make this concept clear and memorable.

Try this practical exercise: Give your tween $20 and create a shopping scenario with both needs (healthy lunch items) and wants (candy, toys, games). Let them navigate the choices themselves, experiencing firsthand how budget constraints require prioritization.

These real-world simulations develop decision-making skills in a low-stakes environment. When tweens later face similar choices with their own money, they’ll have experience weighing options and understanding trade-offs.

Maximizing Windfalls: Birthday Money and Gift Cash

Windfalls like birthday money, holiday gifts, or special rewards present valuable teaching moments. Rather than allowing tweens to spend everything immediately, establish a guideline of saving at least 50% of unexpected money.

This practice serves multiple purposes: it reinforces saving habits, prevents the boom-and-bust spending cycle that many adults struggle with, and demonstrates that receiving money doesn’t automatically mean spending money.

Consider giving tweens the flexibility to modify their 3-bucket allocations when they receive unexpected money. Perhaps they allocate 30% to spend, 60% to save, and 10% to give when they receive birthday money. This flexibility teaches adaptability while maintaining the core budgeting structure.

Comparison Shopping: Building Smart Consumer Habits

Tweens often make purchasing decisions impulsively, but comparison shopping teaches them to be intentional consumers. Show them how to evaluate different options based on price, quality, and value before making purchases.

Start with simple examples relevant to their lives. When they want a new notebook, visit different stores or check online prices together. Demonstrate how choosing a less expensive option allows more money to go toward their savings goals.

This skill proves invaluable as tweens grow older and face increasingly complex financial decisions. Learning to research and compare options now builds critical thinking skills that will serve them throughout life.

Family Budget Involvement: Teaching Through Participation

Including tweens in appropriate family budgeting activities provides real-world context for their personal budgeting lessons. Give them small, manageable responsibilities like planning the snack budget for a family picnic with a $30 limit.

These exercises teach several valuable lessons simultaneously: money is finite, choices have consequences, and smart planning leads to better outcomes. Tweens learn that adults face the same budgeting challenges they do, just on a larger scale.

Keep family financial discussions age-appropriate. Tweens don’t need to know specific family income details, but they can understand general concepts like household expenses and the importance of living within means.

Digital Money Education: Preparing for Tomorrow’s Reality

Most tweens see parents using credit and debit cards daily, but they may not understand the difference between these payment methods. Early education about digital money prevents confusion and potential problems later.

Explain that debit cards access money you already have in the bank, while credit cards represent borrowed money that must be repaid—often with interest if not paid promptly. Use simple analogies they can understand: a debit card is like spending from your wallet, while a credit card is like borrowing from a friend who expects repayment.

This foundation prepares tweens for the cashless society they’ll inherit while maintaining healthy skepticism about easy credit.

Positive Reinforcement: Celebrating Smart Financial Choices

Recognizing and praising good financial decisions reinforces positive behaviour patterns. When your tween chooses to save money instead of making an impulse purchase, acknowledge their self-control and wisdom.

Consider small incentives for consistently good financial choices—perhaps matching their savings contributions or allowing them to adjust their bucket percentages temporarily. These rewards shouldn’t overshadow the intrinsic satisfaction of meeting financial goals, but they can provide additional motivation during the learning process.

Summary: Building Financial Confidence Step by Step

Successfully teaching budgeting to tweens takes a blend of patience, steady guidance, and innovative approaches.. The 3-bucket system provides structure, while allowances, goal-setting, and hands-on activities make learning engaging and memorable. Technology tools support these lessons while preparing tweens for digital financial management.

Remember that financial education is an ongoing process. Your tween won’t master these concepts immediately, and that’s perfectly normal. Mistakes provide learning opportunities, and consistent guidance builds lasting skills.

The time and effort you invest in your tween’s financial education today will benefit them for decades to come.” You’re not just teaching budgeting—you’re building confidence, responsibility, and the foundation for financial independence.

Frequently Asked Questions

Q: What if my tween spends all their money immediately despite our budget talks? A: This is normal behaviour that requires patience and natural consequences. Let them experience running out of money rather than rescuing them immediately. Use these moments as teaching opportunities to discuss how budgeting prevents this problem.

Q: Should I control how my tween spends their “spend” bucket money? A: Generally, no—as long as purchases are age-appropriate and safe. The spend bucket teaches decision-making skills, and tweens need freedom to make choices (and mistakes) within reasonable boundaries.

Q: How do I handle peer pressure around spending? A: Discuss how different families have different priorities and resources. Role-play scenarios where your tween might feel pressured to spend money they’ve allocated for savings. Emphasize that sticking to their goals shows maturity and wisdom.

Q: What if my tween loses interest in saving for their goal? A: This happens frequently. Help them evaluate whether the goal still matters to them or if they need a different, more motivating target. Sometimes breaking large goals into smaller milestones rekindling enthusiasm.

Ready to Start Your Family’s Financial Journey?

While it would have been ideal to start teaching budgeting skills earlier, there’s no better moment than right now to begin. Start with one simple step: introduce the 3-bucket system this week. Watch as your tween begins developing financial confidence that will serve them throughout their life. Your child’s financial future begins with the lessons you teach today. Each budgeting lesson you teach today helps your tween build toward a future of financial confidence and stability.