$50K - A Year Is How Much an Hour: Ultimate Salary Breakthrough for Ambitious Professionals

Making $50,000 a year is a common milestone for many working professionals, but what does that actually mean in terms of hourly wages? Whether you’re evaluating a job offer, planning your budget, or wondering is 50k a year good for your situation, understanding how your annual salary breaks down can help you make better financial decisions and even save $10,000 in a year through smart budgeting.

Table of Contents

Salary Breakdown: 50K Annual to Hourly

Let’s start with the math. 50k a year is how much an hour depends on how many hours you work, but here’s the complete breakdown:

Standard 40-Hour Work Week:

- $50,000 ÷ 2,080 hours = $24.03 per hour

- This assumes 40 hours per week × 52 weeks = 2,080 total work hours

If You Work Overtime (50 hours/week):

- $50,000 ÷ 2,600 hours = $19.23 per hour

- This calculation: 50 hours × 52 weeks = 2,600 hours

Other Useful Breakdowns:

- Daily: $192.31 (based on 260 workdays)

- Weekly: $961.54 (52 weeks)

- Biweekly: $1,923.07 (26 pay periods)

- Monthly: $4,166.67 (12 months)

So when someone asks “50000 a year is how much an hour” or “how much is $50 000 a year per hour”, the answer is approximately $24 per hour for a standard full-time position.

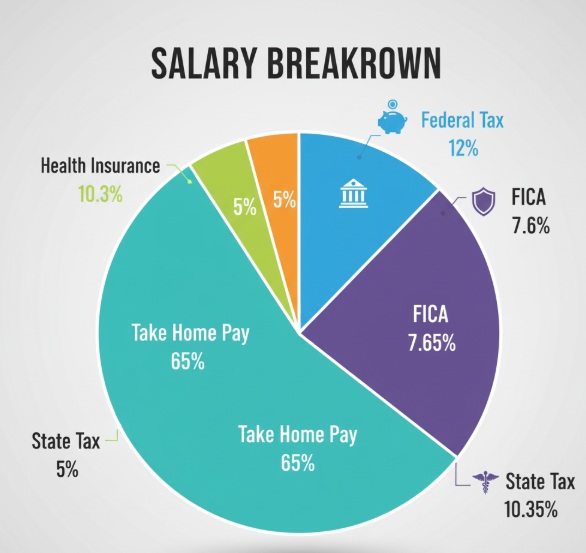

After-Tax Reality: What You Actually Take Home

Here’s where many people get surprised. Your gross salary of $50,000 isn’t what hits your bank account. After taxes and deductions, your take-home pay will be significantly less.

Taxes You’ll Pay:

- Federal Income Tax: Varies by filing status and deductions

- FICA Taxes: 7.65% (Social Security 6.2% + Medicare 1.45%)

- State Income Tax: Varies by state (some states have no income tax)

- Local Taxes: Depends on your city/county

Other Common Deductions:

- Health insurance premiums

- Retirement contributions (401k, etc.)

- Dental and vision insurance

- Life insurance premiums

Real-World Example: Sarah lives in Ohio and earns $50,000. After federal taxes (~12%), FICA (7.65%), state taxes (~3%), and health insurance ($200/month), she takes home approximately $3,100 monthly instead of the gross $4,166.67.

Pro Tip: Use online paycheque calculators to estimate your actual take-home pay before making major financial decisions.

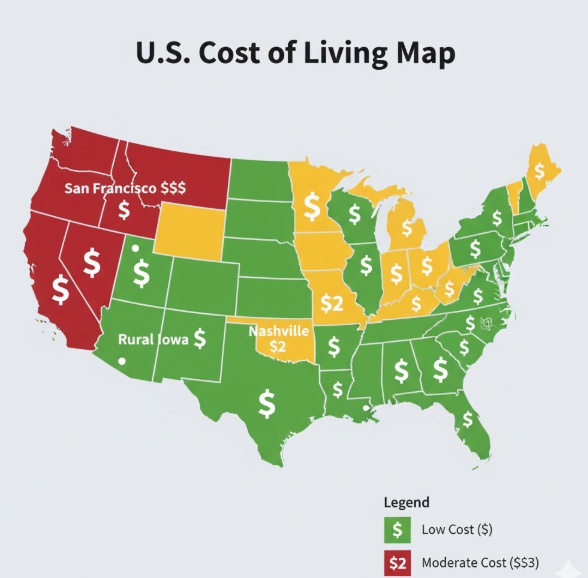

Is 50K a Year Good? Location and Lifestyle Matters

The question “is 50k a year good” or “is 50000 a year good” doesn’t have a one-size-fits-all answer. It depends on several key factors:

Cost of Living by Location: The same $50,000 goes much further in some areas than others. For context, the median U.S. household income is approximately $57,000, making $50K slightly below average.

- High-Cost Areas (San Francisco, NYC): $50K might cover basic expenses but leaves little for savings

- Moderate-Cost Areas (Denver, Austin): $50K can provide a comfortable lifestyle with careful budgeting

- Low-Cost Areas (Rural Midwest, South): $50K can go quite far and allow for substantial savings

Family Situation Matters:

- Single person: $50K can provide a comfortable lifestyle in most areas

- Single parent: May require careful budgeting and potentially side income

- Dual-income household: Combined with a partner’s income, creates more financial flexibility

Living Comfortably on $50,000: Real-World Examples

Let me share some real examples of how people make $50K work:

Example 1: Jake in Nashville, TN

- Rent: $1,200/month (studio apartment)

- Take-home after taxes: ~$3,200/month

- Remaining for food, transportation, savings: $2,000/month

- Result: Lives comfortably with $500/month for savings

Example 2: Maria in Phoenix, AZ

- Mortgage: $1,400/month (purchased a small home)

- Take-home pay: ~$3,100/month

- Budgets carefully and runs a weekend side business

- Result: Building equity and saving $200/month

Example 3: David in Rural Iowa

- Rent: $700/month (2-bedroom apartment)

- Take-home pay: ~$3,200/month

- Low cost of living allows aggressive saving

- Result: Saves $1,000+ monthly and is on track to save $10,000 in a year

Smart Money Management Tips for 50K Earners

Making $50K work requires strategic financial planning. Here are proven strategies:

1. Avoid Lifestyle Inflation Just because you’re earning $50K doesn’t mean you need to spend it all. Many people increase spending to match income increases, which prevents wealth building.

2. Use the 50/30/20 Budget Rule

- 50% for needs (housing, food, transportation)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt payment

3. Track Your Spending Use apps like Mint, YNAB, or even a simple spreadsheet to see where your money goes. You might be surprised at small expenses that add up.

4. Plan Before Big Purchases Whether it’s a car, vacation, or major appliance, save up first rather than financing everything.

5. Build an Emergency Fund Start with $1,000, then work toward 3-6 months of expenses. This prevents debt when unexpected costs arise.

Ways to Boost Your Income Beyond 50K

If 50 000 a year is how much an hour isn’t cutting it for your financial goals, consider these income-boosting strategies:

- Overtime hours (if available and you’re hourly)

- Side gigs: Uber, DoorDash, freelance work

- Selling items: Declutter and sell unused belongings

Medium-Term Strategies:

- Skill development: Learn new skills for promotion opportunities

- Side business: Start a small business in your spare time

- Passive income: Invest in dividend stocks or REITs

Long-Term Approaches:

- Education/Certification: Increase your market value

- Career change: Move to higher-paying industries

- Entrepreneurship: Start your own business

Common Jobs That Pay Around $50,000

Wondering what careers typically offer this salary range? Here are some examples:

Without a College Degree:

- Electrician apprentice

- Insurance sales representative

- Truck driver

- Medical assistant

- Customer service manager

With a College Degree:

- Dental hygienist

- Business analyst (entry-level)

- Communications coordinator

- Loan officer

- Human resources assistant

Growing Fields: Many of these roles offer advancement opportunities that can quickly take you beyond the $50K mark with experience.

Saving and Debt Management Strategies

Even on $50K, you can build wealth and pay off debt with the right approach:

- Debt avalanche: Pay minimums on all debts, extra on highest interest rate

- Debt snowball: Pay minimums on all debts, extra on smallest balance

- Debt consolidation: Combine high-interest debts into lower-rate loan

Savings Strategies:

- Automate savings: Set up automatic transfers to savings accounts

- Take advantage of employer 401k match: Free money you shouldn’t leave on the table

- High-yield savings account: Earn more on your emergency fund

- Challenge yourself: Try a 52-week savings challenge or no-spend month

How to Save $10,000 in a Year on 50K: This is absolutely achievable! Break it down to $833 per month or $192 per week. Combine expense cutting with income boosting:

- Cut one major expense (cable, expensive car payment): $100/month

- Side gig income: $400/month

- Meal prep instead of eating out: $150/month

- Shop smarter for groceries and utilities: $100/month

- Sell unused items: $83/month average

Your Next Steps to Financial Success

Understanding that 50k a year is how much an hour ($24.03 for full-time work) is just the beginning. The real question isn’t whether $50K is “good” – it’s whether you’re maximizing its potential.

Whether is 50 000 a year good for your situation depends on your location, family size, and financial goals. But with smart budgeting, strategic side income, and disciplined saving, you can build wealth on this salary.

Remember, many successful people started with modest salaries. The key is living below your means, continuously improving your skills, and making your money work for you through smart saving and investing.

Ready to take control of your finances? Start by calculating your exact hourly wage, creating a budget that works for your lifestyle, and setting up automatic savings to reach your financial goals. Your future self will thank you for the steps you take today.