Discover the proven path to financial freedom and take control of your financial future

Table of Contents

Imagine waking up tomorrow knowing that your bills are covered, your future is secure, and you have the freedom to choose how you spend your time. This isn’t just a dream—it’s financial independence, and it’s more achievable than you might think.

Whether you’re a teacher earning $45,000 a year or a software engineer making six figures, the principles of building wealth and achieving financial freedom remain remarkably consistent. Today, we’re going to walk through exactly how you can join the growing community of Americans who’ve taken control of their financial destiny.

What Is Financial Independence (FI)?

Financial independence means having enough assets and passive income to cover your living expenses without relying on traditional employment. It’s not about being rich in the flashy sense—it’s about having genuine security and choice in your life.

When you’re financially independent, you’ve reached a point where:

- Your essential expenses are covered without financial stress

- You’ve eliminated or significantly reduced high-interest debt

- Your investments generate enough income to sustain your lifestyle

- You have the freedom to work because you want to, not because you have to

Think of Sarah, a marketing manager from Denver who achieved financial independence at 38. She didn’t inherit money or win the lottery. Instead, she systematically saved 40% of her income for 12 years while living in a modest apartment and driving a reliable used car. Today, she volunteers at animal shelters and teaches yoga—work she’s passionate about but that doesn’t necessarily pay all the bills.

This concept ties directly into what’s known as the FIRE movement—Financial Independence, Retire Early—but don’t let the “retire early” part fool you. This isn’t necessarily about sitting on a beach doing nothing. It’s about regaining control of your most precious resource: time.

Understanding the FIRE Movement

The FIRE movement has gained tremendous momentum among working professionals who are tired of the traditional “work until 65” model. At its core, FIRE is about saving and investing aggressively now so you can have complete choice over your time later.

Here’s what financial independence can offer you:

- Career flexibility: Continue working in your current job without the pressure of needing the pay check

- Pursuit of passions: Switch to meaningful work that might pay less but brings fulfilment

- Lifelong learning: Go back to school, learn new skills, or explore creative pursuits

- Travel and experiences: Spend extended time traveling or living in different places

- Community service: Dedicate time to volunteer work and giving back

The beauty of the FIRE approach is that it’s not all-or-nothing. Even if you don’t achieve complete financial independence by 35, the habits and principles you’ll develop will dramatically improve your financial security and give you more options throughout your life.

The Financial Independence Formula

Let’s get practical. Financial independence isn’t magic—it’s math. There are two key formulas that will guide your journey:

Your FI Number

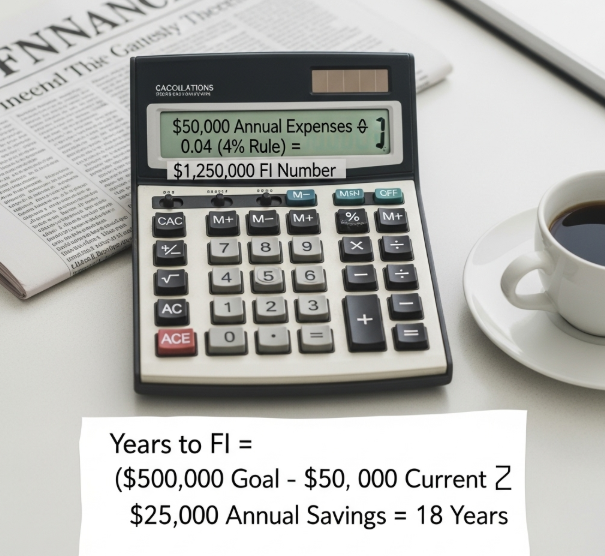

FI Number = Annual Spending ÷ Safe Withdrawal Rate

Most people in the FI community use the 4% rule as their safe withdrawal rate, though we’ll discuss why you might want to be more conservative later.

Here’s how it works: If you spend $50,000 per year and use a 4% withdrawal rate, your FI number would be: $50,000 ÷ 0.04 = $1,250,000

If you’re more conservative and use a 3.5% withdrawal rate: $50,000 ÷ 0.035 = $1,428,571

Years to Financial Independence

Years to FI = (FI Number – Current Savings) ÷ Annual Savings

Let’s say your FI goal is $500,000, you currently have $50,000 saved, and you can save $25,000 per year: ($500,000 – $50,000) ÷ $25,000 = 18 years

Of course, this simplified calculation doesn’t account for investment growth, which can significantly accelerate your timeline. A diversified portfolio historically returning 7-10% annually can cut years off your journey to financial independence.

5 Practical Steps to Reach Financial Independence

Step 1: Eliminate High-Interest Debt

Before you can build wealth, you need to stop wealth from leaking out through high-interest debt payments. Credit card debt averaging 18-24% annual interest rates will sabotage any investment strategy.

Two proven debt elimination strategies:

Debt Snowball Method: Pay minimums on all debts, then attack the smallest balance first. This builds psychological momentum.

Debt Avalanche Method: Pay minimums on all debts, then focus extra payments on the highest interest rate debt first. This saves more money mathematically.

Take Mike, an accountant from Phoenix, who had $35,000 in credit card debt across four cards. Using the avalanche method, he focused his extra $800 monthly payments on his 23.9% APR card first, saving over $8,000 in interest compared to making minimum payments.

Don’t forget about your mortgage—while not necessarily “high-interest,” eliminating this payment can significantly reduce your FI number since housing typically represents 25-30% of most people’s budgets.

Step 2: Save and Invest Aggressively

This is where the magic happens. While the average American saves less than 10% of their income, those pursuing financial independence typically save 20-50% or more.

Automation is key: Set up automatic transfers to your investment accounts right after payday. If you don’t see the money, you won’t miss it.

Investment basics for FI seekers:

- Emergency fund: 3-6 months of expenses in a high-yield savings account

- 401(k) match: Always capture your full employer match—it’s free money

- Index funds: Low-cost, diversified funds that track market performance

- Asset allocation: Balance stocks and bonds based on your risk tolerance and timeline

Consider Jessica, a nurse practitioner who automated 35% of her $85,000 salary into investments. She maxed out her 401(k) ($22,500), contributed to a Roth IRA ($6,000), and invested an additional $1,200 monthly in taxable accounts through low-cost index funds.

Step 3: Increase Your Income

There’s a limit to how much you can cut expenses, but there’s virtually no limit to how much you can earn. Focus on strategies that provide the biggest return on your time investment.

High-impact income strategies:

- Skill development: Invest in certifications or education that lead to promotions

- Side hustles: Freelance work, consulting, or gig economy opportunities

- Passive income streams: Create products, courses, or content that generate ongoing revenue

- Job optimization: Negotiate raises, change companies strategically, or transition to higher-paying roles

David, a software developer, increased his income from $75,000 to $120,000 in three years by obtaining cloud computing certifications, switching companies twice strategically, and doing weekend freelance projects. The additional $45,000 annually accelerated his path to financial independence by nearly a decade.

Step 4: Optimize Your Expenses

Smart expense reduction focuses on the big three: housing, transportation, and food. These typically account for 60-70% of most people’s spending.

Housing optimization:

- Consider house hacking (rent out rooms or units)

- Relocate to lower cost-of-living areas if possible

- Refinance your mortgage when rates drop

Transportation savings:

- Buy reliable used cars instead of new

- Use public transportation or bike when practical

- Consider car-sharing services instead of ownership

Food and lifestyle:

- Meal planning and cooking at home

- Generic brands for household items

- Cancel unused subscriptions and memberships

Remember Lisa, a teacher who reduced her housing costs from $2,000 to $1,200 by moving to a smaller apartment closer to work. She also sold her car payment and bought a reliable used Honda Civic. These two changes alone freed up $1,000 monthly for investments.

Step 5: Stay Flexible and Adapt

Financial independence isn’t a “set it and forget it” goal. Markets fluctuate, life circumstances change, and your plans may need adjustment.

Key areas to monitor:

- Market conditions: Be prepared to adjust withdrawal rates during market downturns

- Lifestyle changes: Marriage, children, health issues, or career changes may affect your timeline

- Goal evolution: Your definition of financial independence may change as you progress

Sequence of returns risk: The order in which you experience investment returns matters greatly, especially in early retirement. Having 2-3 years of expenses in conservative investments can protect you from selling stocks during market lows.

Understanding Safe Withdrawal Rates

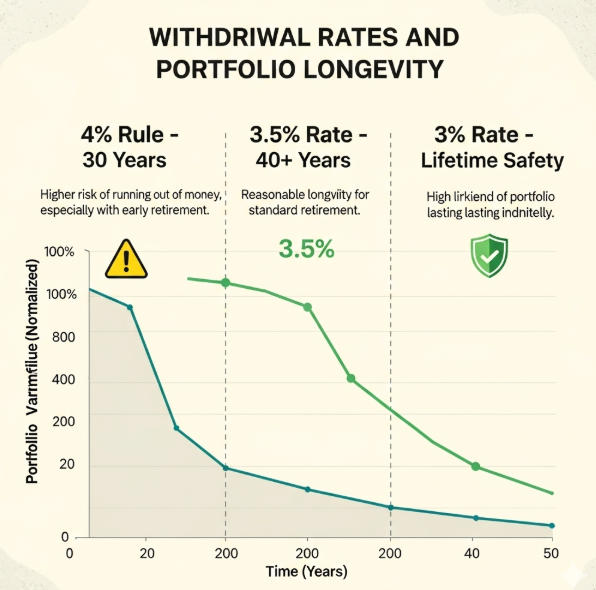

The famous 4% rule comes from research showing that historically, a retiree could withdraw 4% of their initial portfolio value (adjusted for inflation) and not run out of money over a 30-year retirement.

However, there are important considerations for early retirees:

Why 4% might be too aggressive:

- Longer retirement periods (40+ years vs. 30 years)

- Current market valuations and bond yields

- Sequence of returns risk in early retirement years

Conservative approaches:

- Use 3.5% or even 3% withdrawal rates for safety

- Implement flexible spending strategies

- Maintain the ability to earn some income if needed

Many in the FI community use a “glide path” approach, starting with more conservative withdrawal rates and gradually increasing them as they age and their remaining life expectancy decreases.

Do You Really Need $1 Million to Retire?

The “$1 million retirement” figure gets thrown around constantly, but it’s not a universal magic number. Your personal FI number depends entirely on your lifestyle and spending needs.

Lower FI number examples:

- Rural areas with lower cost of living

- Paid-off homes reducing housing expenses

- Minimalist lifestyles with lower consumption

- Geographic arbitrage (living in low-cost countries)

Higher FI number scenarios:

- Expensive metropolitan areas

- Families with children and education expenses

- Health issues requiring higher medical spending

- Luxury lifestyle preferences

Consider Tom and Maria, a couple who achieved financial independence with $650,000. They live in a small town in Tennessee, own their home outright, and have simple tastes. Their annual expenses of $26,000 make their nest egg more than sufficient using a 4% withdrawal rate.

Conversely, Alex, a single professional in San Francisco, calculated he needs $2.1 million for his FI number due to his $84,000 annual expenses in one of America’s most expensive cities.

The FI Mindset: Building Mental Wealth

Achieving financial independence requires more than just mathematical formulas—it demands a fundamental shift in how you think about money, time, and success.

Mental frameworks for success:

Delayed gratification: Understanding that temporary sacrifices today lead to permanent freedom tomorrow. This doesn’t mean living like a monk, but being intentional about where you spend money.

Value-based spending: Align your expenses with your true priorities. Spend generously on what brings you joy and cut ruthlessly on what doesn’t.

Long-term thinking: Train yourself to see the compound effect of financial decisions. That $5 daily coffee habit costs $1,825 yearly, or potentially $73,000 over 20 years when you factor in investment growth.

Persistence through setbacks: Market crashes, job losses, and unexpected expenses will happen. Successful FI journeys require the ability to stay the course and adapt when necessary.

Focus on your “why”: Whether it’s spending more time with family, pursuing creative interests, or having security against economic uncertainty, keep your motivation front and centre.

Real-World Success Stories

The Teacher Who Retired at 35: Joe, a high school teacher in Illinois, achieved financial independence by saving 70% of his $42,000 salary through extreme frugality and house hacking. He rented out three bedrooms in his four-bedroom house, essentially living for free while building wealth.

The Corporate Couple: Jennifer and Mark, both working in corporate finance, saved $100,000 annually on their combined $180,000 income. They achieved their FI goal of $1.8 million in 12 years by maximizing tax-advantaged accounts and investing in low-cost index funds.

The Side Hustle Success: Rachel, a graphic designer, built multiple income streams including an Etsy shop, online courses, and freelance work. She increased her income from $48,000 to $95,000 over five years while maintaining her day job, dramatically accelerating her path to financial independence.

These stories share common themes: clear goals, consistent execution, and the willingness to make temporary sacrifices for long-term freedom.

Your Next Steps to Financial Freedom

Financial independence isn’t reserved for high earners or inheritance recipients—it’s achievable for anyone willing to commit to the process. The key is starting where you are with what you have and consistently moving forward.

Your immediate action plan:

- Calculate your current FI number using your annual expenses and chosen withdrawal rate

- Audit your finances to understand exactly where your money goes each month

- Eliminate high-interest debt using either the snowball or avalanche method

- Automate your savings by setting up transfers to investment accounts

- Optimize your biggest expenses—housing, transportation, and food

- Develop additional income streams through skills, side hustles, or passive investments

- Stay educated by reading FI blogs, books, and connecting with like-minded communities

Remember, financial independence is less about reaching a specific dollar amount and more about creating a sustainable plan around your lifestyle and goals. Whether your FI number is $500,000 or $2 million, the principles remain the same: spend less than you earn, invest the difference wisely, and stay consistent over time.

The journey to financial independence requires discipline, sacrifice, and persistence, but the payoff—true freedom over your time and choices—makes every step worthwhile. Your future financially independent self is counting on the decisions you make today.

Pingback: 50K a Year Is How Much an Hour