How to Invest $100: A Beginner's Guide to Building Wealth

Table of Contents

Your First $100 Can Change Your Financial Future

Think you need thousands of dollars to start investing? Think again. If you’re wondering how to invest $100, you’re already asking the right question. The truth is, your first hundred dollars is one of the most powerful investments you’ll ever make—not because of its size, but because it builds the habit, confidence, and foundation for long-term wealth building.

Many Americans delay investing because they’re waiting to save more money. But here’s the secret: starting small and staying consistent beats waiting for the “perfect” moment. Thanks to modern technology, platforms now offer fractional shares and zero-fee accounts, making it easier than ever for beginners to enter the market.

This guide will show you exactly how to start investing with just $100, which accounts to open, what to invest in, and how to grow your money over time—all while keeping things simple and jargon-free

Step 1: Open the Right Brokerage Account

Before you can invest, you need a place to put your money. Choosing the best brokerage accounts for small investments is crucial for beginner investing.

Types of Accounts to Consider

For Long-Term Goals (Retirement):

- Roth IRA for beginners: Contributions grow tax-free, and withdrawals in retirement are tax-free. Perfect if you’re young and expect higher earnings later.

- Traditional IRA: Tax-deductible contributions now, but you’ll pay taxes on withdrawals in retirement.

For Flexible Goals:

- Taxable brokerage account: Access your money anytime without penalties. Great for mid-term goals like saving for a house or building an emergency fund.

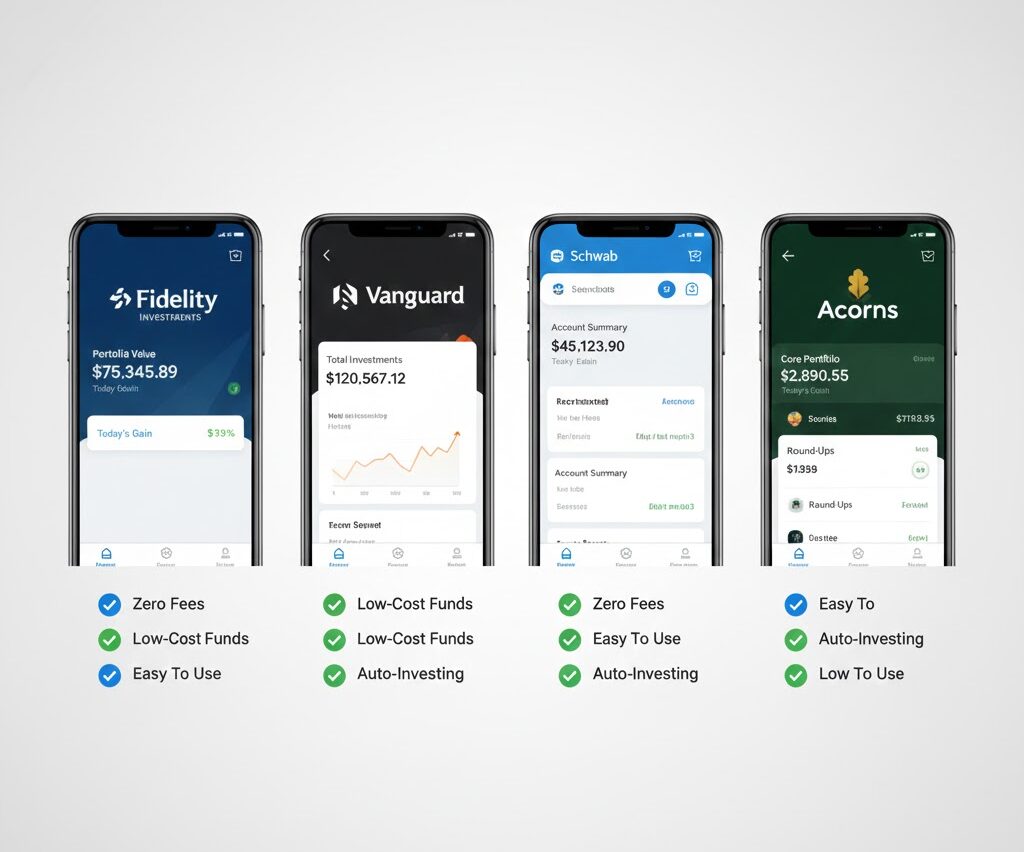

Top Platforms for Small Investors

When choosing a brokerage account for beginners, look for low or zero fees, fractional shares, easy-to-use mobile apps, and SIPC insurance.

Popular Options:

- Fidelity: Zero-fee trades, excellent research tools, strong customer service

- Vanguard: Known for low-cost investing, ideal for long-term investors

- Schwab: User-friendly platform with robust educational resources

- Acorns: Perfect for automated investing—rounds up your purchases and invests the spare change

Comparing Fidelity vs Vanguard vs Schwab? All three are solid choices. Pick based on your preferences: Fidelity for research tools, Vanguard for rock-bottom fees, Schwab for banking integration.

Step 2: Choose a Diversified Investment

Once your account is open, it’s time to decide what to invest in with $100. Here’s the golden rule for a beginner-friendly investing plan: avoid putting all your money into individual stocks.

Why Index Funds Are Perfect for Beginners

Index fund investing offers instant diversification by tracking entire markets. Instead of betting on one company, you’re spreading risk across hundreds or thousands of stocks.

Best Index Funds to Start With

Total Market Index Funds:

- VTI (Vanguard Total Stock Market ETF): Tracks the entire U.S. stock market—over 3,500 companies

- FZROX (Fidelity Zero Total Market Index Fund): Zero expense ratio, covers the whole market

S&P 500 Index Funds:

- VOO (Vanguard S&P 500 ETF): Tracks the 500 largest U.S. companies

- FXAIX (Fidelity 500 Index Fund): Low fees, follows the S&P 500 index fund benchmark

Target-Date Funds:

- Ideal for Roth IRA holders

- Automatically adjusts your portfolio as you age

- Example: Vanguard Target-date funds for retirement planning

With fractional shares, you can buy portions of expensive funds even with just $100, giving you a diversified portfolio from day one.

Step 3: Set Up Recurring Investments

The secret to how to invest consistently with small amounts? Automation. Don’t rely on remembering to invest—make it automatic.

How to Automate Your Investing

- Schedule recurring investments: Start with $10–$25 weekly or monthly

- Reinvest dividends: Let your earnings buy more shares automatically

- Increase gradually: Bump up your contribution whenever you get a raise

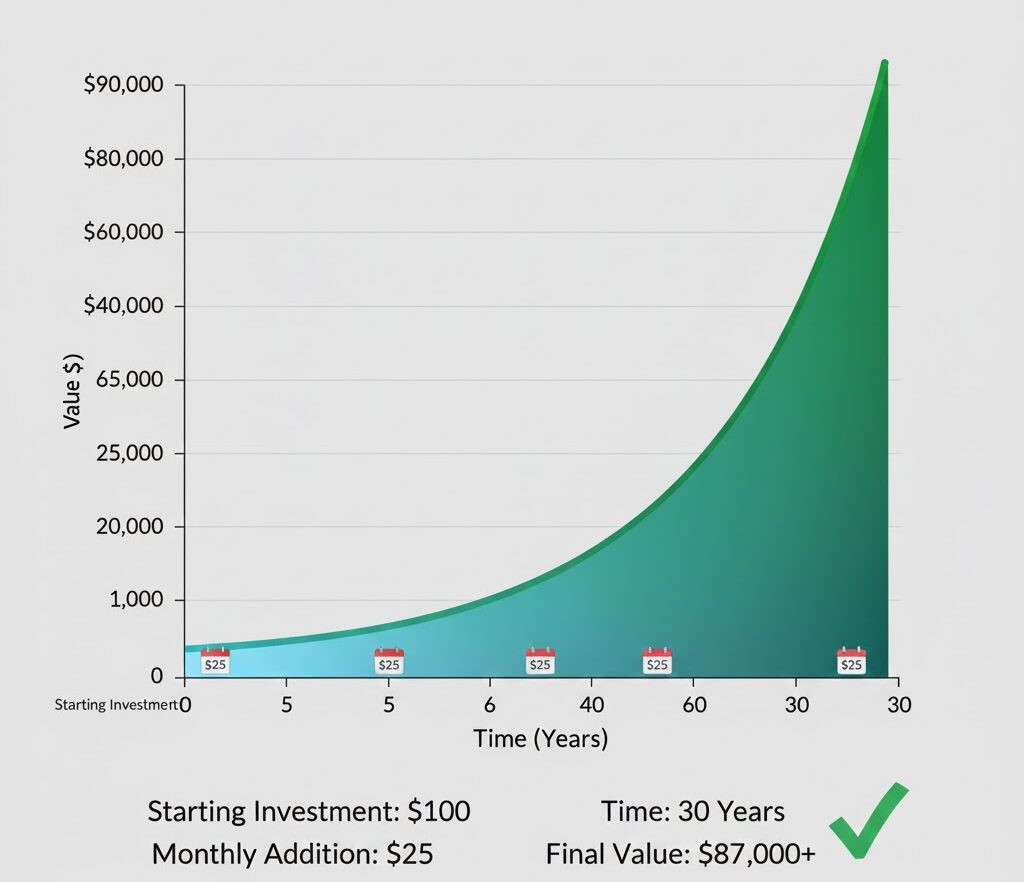

Why This Works: Consistency matters more than amount. Investing $25 every two weeks for 30 years (assuming 8% annual returns) can grow to over $87,000. That’s the magic of compound growth.

Acorns investing makes this incredibly easy by automatically rounding up your purchases and investing the difference.

Step 4: Keep Learning as You Invest

Investing isn’t a “set it and forget it” hobby—though your portfolio can be! The more you learn, the more confident you’ll become.

Free Resources for Beginners

- Books: “The Simple Path to Wealth” by JL Collins, “The Little Book of Common Sense Investing” by John Bogle

- Podcasts: “ChooseFI,” “Afford Anything,” “The Money Guy Show”

Follow credible, non-hype educators who focus on long-term wealth building rather than get-rich-quick schemes.

Step 5: Block Out Noise and Stick to Your Goals

The biggest mistake new investors make? Panicking when market drops and investing seem to be at odds.

What to Do When Markets Drop

If the market drops, stay invested. Market fluctuations are normal. Historically, the U.S. stock market has always recovered and grown over the long term. Selling during a downturn locks in losses—staying the course lets you benefit from the recovery.

Ignore the Noise

- Don’t chase trending stocks or cryptocurrencies

- Avoid checking your portfolio daily

- Review your goals quarterly, not constantly

- Remember: patience plus a long-term mindset equals success

Tax-advantaged accounts like IRAs help you stay disciplined by discouraging early withdrawals.

Expert Advice: Don't Wait for "More Money"

Financial experts agree: is $100 enough to start investing? Absolutely. The biggest mistake isn’t starting small—it’s not starting at all.

Why Starting Now Matters

Investing early and consistently matters more than investing a large amount once. Thanks to compound growth, even small amounts grow exponentially over time. A 25-year-old who invests $100 monthly until retirement will likely have more wealth than a 35-year-old who invests $200 monthly—despite contributing less money overall.

FAQs: Common Questions About Investing $100

Q: Can $100 really grow my wealth? Yes! Through compound growth, $100 invested in an S&P 500 index fund historically doubles approximately every 10 years.

Q: Should beginners start with index funds? Absolutely. Index fund investing provides instant diversification, low-cost investing, and historically strong returns—perfect for best investments for beginners.

Q: How do I choose a brokerage account for beginners? Look for platforms with low fees, fractional shares, good reviews, and SIPC insurance. Compare Fidelity vs Vanguard vs Schwab based on your priorities.

Q: What if I can’t afford more than $100? Start there! Set up automated investing for as little as $10 monthly. Building the habit matters more than the amount.

Final Thoughts: Your Journey to Financial Freedom Starts Now

How to invest your first $100 isn’t complicated—open the right brokerage account for beginners, choose a diversified portfolio of index funds, automate your contributions, and stay patient. Your first $100 is powerful because it builds the habit, confidence, and foundation for wealth building.

Don’t wait for the “perfect” time or a bigger paycheque. The best time to start investing with $100 was yesterday. The second-best time is today. Open that account, invest in a total market index fund or S&P 500 index fund, and take your first step toward financial freedom.

Remember: consistency beats perfection. Start small, stay consistent, and watch your wealth grow.