Hey there, fellow working professionals! Today we’re diving into one of those financial terms that sounds more complicated than it actually is: the bond sinking fund. Whether you’re building your investment portfolio or just trying to understand how companies manage their debt, this guide will break everything down in plain English.

Think of this as your friendly neighborhood financial coach explaining why bond sinking funds matter for your money decisions – and how you can apply similar principles to your own financial planning.

Table of Contents

What is a Bond Sinking Fund?

A bond sinking fund is essentially a savings account that companies create specifically to pay back their bonds. Here’s the simple breakdown: when a company issues bonds (basically borrowing money from investors like you), they set aside money regularly into a special fund. This fund exists for one purpose – to repay part or all of those bonds before they mature.

Imagine you borrowed $10,000 from a friend and promised to pay it back in five years. Instead of scrambling to find the full amount at the end, you decide to save $2,000 each year. That yearly savings plan? That’s essentially how a bond sinking fund works for corporations.

The beauty of this system lies in its predictability and risk reduction. Companies don’t wait until the last minute to gather repayment funds, and investors get added security knowing there’s money specifically earmarked for their bond repayment.

How Bond Sinking Funds Work

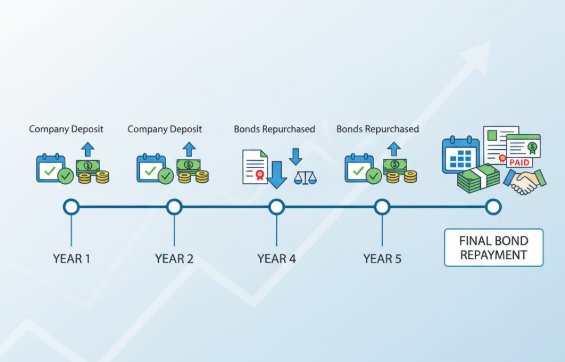

The mechanics of a bond sinking fund are surprisingly straightforward. When a company issues bonds, they establish a schedule for making regular deposits into the sinking fund. These deposits typically happen annually, creating a growing pool of money dedicated solely to bond redemption.

Here’s where it gets interesting for investors: companies can use sinking fund money in two ways. They can either repurchase bonds on the open market (usually when bond prices are below face value) or randomly select bonds for early redemption at face value.

For the company’s balance sheet, the bond sinking fund appears as a long-term asset. This isn’t cash they can use for daily operations – it’s restricted money with one job: paying back bondholders.

The fund management usually involves conservative investments like treasury securities or high-grade corporate bonds, ensuring the money stays safe while earning modest returns.

Benefits for Companies and Investors

For Companies:

Bond sinking funds offer several compelling advantages for corporations. First, they significantly reduce default risk. By systematically setting aside money, companies avoid the potential crisis of facing a massive debt payment without adequate resources.

This structured approach to debt management also strengthens the company’s financial stability profile, often leading to better credit ratings and lower borrowing costs for future debt issuances. Investors and credit rating agencies view sinking fund provisions as a sign of responsible financial management.

Additionally, companies save on interest costs over time. By retiring portions of debt early, they reduce the total interest payments over the bond’s life.

For Investors:

From an investor’s perspective, bond sinking funds create a more secure investment environment. The systematic debt reduction means lower default risk, making these bonds particularly attractive to conservative investors seeking steady income with reduced risk.

However, there’s a trade-off to consider. While your investment becomes safer, you might face early redemption at face value even when market prices are higher. This limits your potential capital gains if interest rates decline and bond prices rise.

Real-World Examples:

Let’s look at some concrete examples to see bond sinking funds in action:

Example 1: Utility Company Bonds ABC Electric Company issues $100 million in 20-year bonds with a 4% annual coupon. They establish a sinking fund requiring $4 million annual deposits starting in year 10. Over the final 10 years, they accumulate $40 million, allowing them to retire 40% of the bonds early and reducing their final maturity payment to $60 million.

Example 2: Manufacturing Corporation XYZ Manufacturing issues $50 million in bonds with a sinking fund provision allowing them to repurchase up to 5% of outstanding bonds annually at market price. When interest rates rise and their bonds trade at 90% of face value, they use sinking fund money to buy back $2.5 million worth of bonds at the discounted market price, saving money while fulfilling their sinking fund obligations.

Example 3: Technology Sector TechCorp’s bond sinking fund requires random selection for early redemption. As an investor holding $10,000 in TechCorp bonds, you might receive notice that your bonds have been selected for early redemption at face value, even if market conditions would have allowed you to sell them for $11,000.

Impact on Your Investment Portfolio

Understanding bond sinking funds helps you make smarter investment decisions. When evaluating corporate bonds, look for sinking fund provisions in the bond prospectus. These provisions tell you:

- How much money the company sets aside annually

- Whether redemptions are random or market-based

- The timeline for sinking fund activities

- Your potential exposure to early redemption

For portfolio diversification, bonds with sinking fund provisions often provide:

- Lower default risk (good for conservative allocations)

- Potentially lower yields (due to reduced risk)

- Limited upside potential in declining interest rate environments

- More predictable cash flows

Consider balancing sinking fund bonds with other fixed-income investments to optimize your risk-return profile.

Creating Your Personal Sinking Fund

The bond sinking fund concept isn’t just for corporations – you can apply the same principle to your personal finances! Here’s how working professionals can create their own sinking funds:

Step 1: Identify Your Future Expenses

- Home down payment

- Car replacement

- Major home repairs

- Children’s education

- Vacation fund

Step 2: Calculate Required Savings

If you need $20,000 for a car in four years, save $5,000 annually or about $417 monthly.

Step 3: Automate Your Savings

Set up automatic transfers to dedicated savings accounts for each goal, just like companies automatically fund their bond sinking funds.

Step 4: Choose Appropriate Investments

For shorter-term goals (under 3 years), stick with high-yield savings accounts or CDs. For longer-term objectives, consider conservative bond funds or balanced mutual funds.

This personal sinking fund strategy helps you avoid debt for major purchases and reduces financial stress when big expenses arise.

Key Takeaways for Working Professionals

As you navigate your investment journey, remember these essential points about bond sinking funds:

- Safety First: Bonds with sinking fund provisions typically offer lower default risk, making them suitable for conservative portfolio allocations.

- Trade-offs Exist: While safer, these investments may limit your upside potential during favorable market conditions.

- Read the Fine Print: Always understand the specific sinking fund provisions before investing, including redemption methods and timing.

- Apply the Concept Personally: Use sinking fund principles in your own financial planning to prepare for major future expenses.

- Diversification Matters: Balance sinking fund bonds with other investments to optimize your overall portfolio performance.

The bond sinking fund concept represents smart, systematic financial planning – whether you’re a corporation managing debt or a working professional preparing for life’s big expenses. By understanding how these funds work, you’re better equipped to make informed investment decisions and apply similar strategies to your own financial goals.