How to Budget with Irregular Income: Exclusive 5 Steps Guide to Financial Stability

Managing your finances shouldn’t feel like riding a rollercoaster – even when your paycheck does.

If you’re a freelancer, commission-based salesperson, gig worker, or self-employed professional, you know the challenge of managing money when your income fluctuates from month to month. Learning how to budget with irregular income is essential for achieving financial stability and peace of mind, regardless of how unpredictable your earnings might be.

Table of Contents

Understanding Irregular Income

What is Irregular Income?

Irregular income refers to earnings that vary significantly from month to month, rather than receiving a consistent paycheck. Unlike traditional salary-based employment where you receive the same amount biweekly or monthly, irregular income fluctuates based on various factors.

Examples of Irregular Income

- Freelance work: Writers, designers, consultants whose project-based income varies

- Commission-based sales: Real estate agents, car salespeople, insurance brokers

- Gig economy work: Uber drivers, food delivery workers, TaskRabbit providers

- Seasonal employment: Tax preparers, retail holiday workers, tour guides

- Small business owners: Restaurant owners, contractors, service providers

- Creative professionals: Musicians, artists, actors with project-based income

- Investment income: Dividends, rental income, capital gains

The key characteristic of irregular income is its unpredictability – you might earn $8,000 one month and $2,500 the next.

The Challenges of Variable Income Budgeting

How to budget on a variable income presents unique challenges that traditional budgeting methods don’t address:

Unpredictable Cash Flow

When your income varies, it’s difficult to know exactly how much you’ll have available for expenses each month. This uncertainty makes it challenging to commit to fixed expenses or plan for the future.

Intermittent Expenses

Intermittent expenses are costs that don’t occur monthly but still need to be budgeted for, such as:

- Quarterly tax payments

- Annual insurance premiums

- Equipment replacements

- Professional development costs

Emotional Stress

The feast-or-famine cycle of variable income can create anxiety and lead to poor financial decisions during both high-earning and low-earning periods.

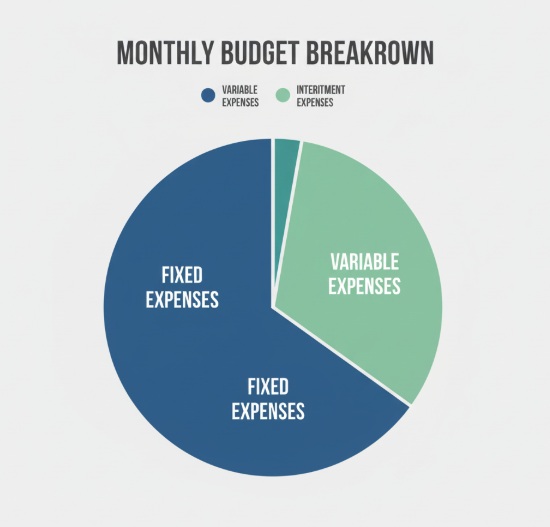

Essential Elements of Any Budget

The three elements of a budget are income, expenses, and the balance between them. For irregular income budgeting, we need to approach each element differently:

1. Income Planning

Instead of budgeting based on guaranteed income, you’ll work with income ranges and averages.

2. Expense Categories

- Fixed expenses: Rent, insurance, minimum debt payments

- Variable expenses: Groceries, utilities, entertainment

- Intermittent expenses: Irregular but necessary costs

3. Buffer Management

The difference between income and expenses becomes your financial buffer for lean months.

Step-by-Step Guide: How to Budget with Irregular Income

Step 1: Calculate Your Baseline Income

Look at your last 12 months of earnings and calculate:

- Lowest monthly income: Your worst month

- Average monthly income: Total annual income ÷ 12

- Highest monthly income: Your best month

Example:

- Lowest: $2,800

- Average: $5,200

- Highest: $9,400

For budgeting purposes, use a conservative estimate – typically 80% of your average monthly income or slightly above your lowest month.

Step 2: List All Your Expenses

Create three categories:

Fixed Expenses (same amount monthly):

- Rent/mortgage: $1,200

- Car payment: $350

- Insurance: $200

- Minimum debt payments: $150

- Total Fixed: $1,900

Variable Expenses (fluctuate monthly):

- Groceries: $400-600

- Utilities: $150-250

- Gas: $100-200

- Entertainment: $100-300

Intermittent Expenses (irregular timing):

- Quarterly taxes: $1,200/quarter = $400/month

- Annual car maintenance: $1,200/year = $100/month

- Professional development: $600/year = $50/month

Step 3: Create Your Base Budget

Using your conservative income estimate, prioritize expenses:

- Essential fixed expenses

- Minimum variable expenses

- Intermittent expense reserves

- Emergency fund contributions

- Additional variable expenses (if income allows)

Step 4: Build Your Financial Buffer System

Create multiple savings accounts:

- Monthly Buffer Account: 2-3 months of expenses

- Intermittent Expense Fund: For irregular but expected costs

- Emergency Fund: 6-12 months of expenses (more than traditional recommendations)

Step 5: Implement the Percentage Method

During high-income months, allocate percentages:

- 50% to current month’s expenses

- 30% to buffer accounts

- 15% to long-term savings/investments

- 5% to discretionary spending

Managing Variable and Intermittent Expenses

Variable Expense Strategies

Variable expenses require flexible planning:

- Set Ranges: Instead of fixed amounts, create spending ranges

- Priority Ranking: List variable expenses by importance

- Scaling System: Plan what to cut when income is low

Intermittent Expense Planning

Intermittent expenses need dedicated planning:

- List All Irregular Costs: Include annual, quarterly, and seasonal expenses

- Calculate Monthly Reserves: Divide annual costs by 12

- Create Sinking Funds: Separate savings accounts for each major irregular expense

Real-World Examples and Case Studies

Case Study 1: Sarah, Freelance Marketing Consultant

Income Pattern: $3,000 – $12,000/month Strategy: Uses 75% of lowest month ($2,250) as base budget Success Factors:

- Maintains 4-month expense buffer

- Automatically saves 40% during high-income months

- Uses project-based budgeting for large expenses

Case Study 2: Mike, Commission-Based Sales

Income Pattern: $4,500 – $15,000/month

Challenge: Payment based on commission can be very inconsistent Strategy:

- Budgets on $4,000/month baseline

- Creates separate accounts for taxes and irregular expenses

- Uses percentage-based allocation system

Case Study 3: Lisa, Gig Economy Worker

Income Pattern: $2,200 – $6,800/month Focus: Low income budgeting with maximum flexibility Strategy:

- Extremely detailed expense tracking

- Multiple income streams for stability

- Aggressive emergency fund building during good months

Tools and Resources for Variable Income Budgeting

Variable Income Calculator Tools

While specific calculators vary, look for tools that help you:

- Calculate average income over different time periods

- Project expenses based on income scenarios

- Track irregular income patterns

Recommended Budgeting Methods

- Zero-Based Budgeting: Assign every dollar a purpose

- Percentage-Based Budgeting: Allocate based on income percentages

- Priority-Based Budgeting: Fund essentials first, then scale up

Banking Setup for Success

- Primary Checking: Monthly expenses only

- Buffer Savings: 2-3 months expenses

- Intermittent Fund: Irregular expenses

- Emergency Fund: Long-term security

- Tax Account: Self-employed tax obligations

Advanced Strategies for Long-Term Success

Income Smoothing Techniques

- Retainer Agreements: Negotiate consistent monthly payments

- Multiple Income Streams: Diversify to reduce volatility

- Seasonal Planning: Prepare for predictable income cycles

Investment Considerations

With irregular income, your investment strategy should be more conservative:

- Larger emergency fund before investing

- Focus on liquid investments initially

- Consider bonds and CDs for stability

Tax Planning for Variable Income

- Make quarterly estimated payments

- Track business expenses meticulously

- Consider SEP-IRA or Solo 401(k) for retirement savings

Common Mistakes to Avoid

1. Budgeting Based on Best Months

Don’t create a budget assuming you’ll always earn your highest income. This leads to overspending and debt accumulation.

2. Ignoring Intermittent Expenses

Failing to plan for irregular but predictable expenses creates false emergencies.

3. Not Building Adequate Buffers

Variable income requires larger emergency funds than traditional employment.

4. Lifestyle Inflation During Good Months

Avoid permanently increasing your lifestyle based on temporary income spikes.

5. Mixing Personal and Business Funds

Keep separate accounts to better track income and expenses.

Your Action Plan Moving Forward

Week 1: Assessment

- Gather 12 months of income records

- List all expenses (fixed, variable, intermittent)

- Calculate your baseline budget income

Week 2: Setup

- Open dedicated savings accounts

- Choose budgeting tools/apps

- Create expense tracking systems

Week 3: Implementation

- Start following your baseline budget

- Begin building buffer funds

- Track actual vs. budgeted expenses

Month 2-3: Refinement

- Adjust budget based on real data

- Optimize savings allocation percentages

- Build emergency fund consistently

Ongoing: Monitoring and Adjustment

- Monthly budget reviews

- Quarterly income assessments

- Annual strategy evaluations

Conclusion

Learning how to budget with irregular income requires a different approach than traditional budgeting, but it’s absolutely achievable. The key is building flexibility into your system while maintaining discipline during both high and low-income periods.

Remember, budgeting with variable income is about creating stability from instability. By using conservative income estimates, building robust buffer systems, and maintaining disciplined spending habits, you can achieve financial security regardless of how much your income fluctuates.

The strategies outlined in this guide have helped thousands of professionals with irregular income build stable financial foundations. Your journey to financial stability starts with implementing these proven techniques consistently, month after month.