States With No Income Tax: Your 2025 Complete Guide to Tax-Free Living

The American Dream of Keeping More of What You Earn

Picture this: it’s payday, you open your paycheque, and there’s no state income tax taken out. Sounds too good to be true. For millions of Americans living in nine specific states, it’s reality.

As of 2025, nine states have chosen not to levy a personal income tax, giving residents the opportunity to keep more of their hard-earned money. But before you start packing your bags for Florida or Texas, there’s more to the story than just tax savings.

This guide breaks down everything you need to know about states with no state income tax—from how much you could save to the hidden costs that might surprise you.

Table of Contents

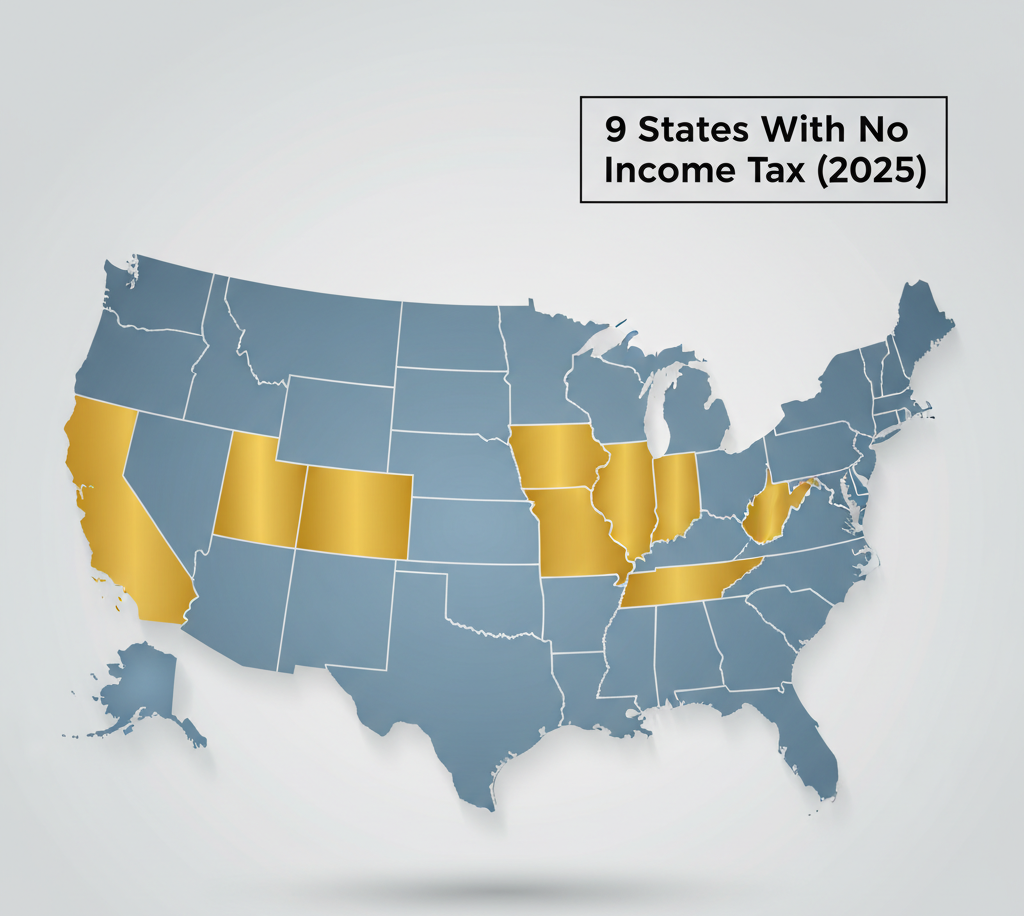

The 9 States With No Income Tax in 2025

Let’s get straight to the point. As of 2025, these nine states do not charge personal income tax on wages:

- Alaska

- Florida

- Nevada

- New Hampshire (new addition as of January 2025)

- South Dakota

- Tennessee

- Texas

- Washington (with exceptions for capital gains)

- Wyoming

Important Note: While Washington doesn’t tax earned income, it does impose a 7% capital gains tax on individuals with annual gains exceeding $270,000. This means high-earning investors should factor this into their planning.

New Hampshire made headlines by becoming the newest full member of this exclusive club in January 2025, when it eliminated its 5% tax on interest and dividends income.

How Much Money Can You Actually Save?

The savings from living in a no-income-tax state can be substantial, especially for middle and higher-income earners.

Real-World Examples

Scenario 1: Middle-Income Family

- Annual household income: $100,000

- Living in a state with 5% income tax vs. no-income-tax state

- Annual savings: $5,000

- 10-year savings: $50,000

Scenario 2: High-Earning Professional

- Annual income: $500,000

- Living in California (11.3% top marginal rate) vs. no-income-tax state

- Annual savings: Over $45,000

- 10-year savings: $450,000+

These numbers represent real money that stays in your pocket—money you can invest, save for retirement, or use to improve your family’s quality of life.

Understanding How These States Fund Their Governments

Here’s the million-dollar question: if these states don’t collect income tax, how do they pay for roads, schools, and other public services?

Each state has its own approach:

The Sales Tax Strategy

Tennessee and Texas lean heavily on sales taxes. Tennessee has one of the highest combined state and local sales tax rates in the nation at 9.55%. When you buy clothes, furniture, or a new car, you’re helping fund state services.

The Property Tax Approach

Texas homeowners know this one well. While there’s no income tax, Texas has relatively high property taxes at 1.36% on average. If you own a $300,000 home, that’s $4,080 annually just in property taxes.

Natural Resource Revenue

Alaska takes a unique approach by tapping into its vast oil and natural gas resources. The state generates significant revenue from energy production royalties and even pays residents an annual Permanent Fund Dividend—essentially the state sharing its oil wealth with you.

Tourism Dollars

Florida generates substantial revenue from its massive tourism industry. With millions of visitors hitting theme parks, beaches, and attractions annually, the state collects significant sales tax from tourists—reducing the burden on residents.

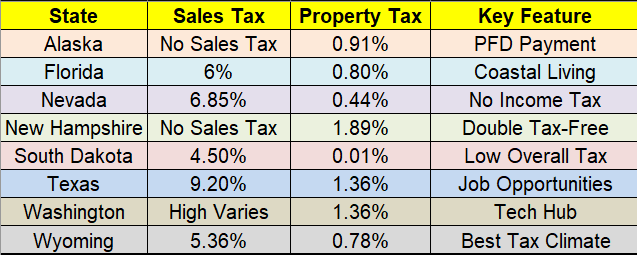

State-by-State Breakdown: What You Need to Know

Alaska: The Last Frontier's Tax Paradise

Quick Facts:

- No income tax ✓

- No statewide sales tax ✓

- Average property tax: 0.91%

- Population: ~730,000

What Makes Alaska Special: Alaska is the only state that pays you to live there through the Permanent Fund Dividend. In recent years, residents have received between $1,000 to $3,200 annually. However, the cost of living is significantly higher due to remote location and harsh weather.

Best For: Adventure seekers, outdoor enthusiasts, and those in natural resource industries

Florida: The Sunshine State's Tax Advantage

Quick Facts:

- No income tax ✓

- 6% state sales tax

- Average property tax: 0.80%

- Population: ~23 million

Why People Are Moving There: Florida consistently leads the nation in net migration, with over 125,000 new residents in recent years. The combination of no income tax, warm weather, and constitutional prohibition against future income taxes makes it a top destination for retirees and remote workers.

Watch Out For: Housing costs have surged in popular areas like Miami, Tampa, and Orlando. Hurricane insurance can also be expensive and hard to obtain.

Best For: Retirees, remote workers, families seeking warm weather

Nevada: Sin City and Beyond

Quick Facts:

- No income tax ✓

- 6.85% average combined sales tax

- Average property tax: 0.44%

- Population: ~3.2 million

The Appeal: Beyond Las Vegas, Nevada offers affordable housing in cities like Reno and Henderson. The state’s business-friendly environment has attracted numerous companies relocating from California.

Considerations: Extreme heat in summer and limited water resources are long-term concerns.

Best For: Entrepreneurs, casino workers, and those seeking western lifestyle with tax benefits

New Hampshire: America's Newest Tax-Free State

Quick Facts:

- No income tax ✓ (as of January 2025)

- No state sales tax ✓

- Average property tax: 1.89% (highest in the nation)

- Population: ~1.4 million

The Trade-Off: While New Hampshire now offers complete freedom from income and sales taxes, property taxes are among the highest nationally. The state makes up for lost revenue through property tax and various fees.

Best For: High earners who rent, Massachusetts workers living near the border, those valuing New England charm

South Dakota: Hidden Gem of the Midwest

Quick Facts:

- No income tax ✓

- 4.5% state sales tax

- Average property tax: 1.01%

- Population: ~900,000

Why It Stands Out: South Dakota offers one of the best overall tax environments in America. Property taxes are reasonable, sales taxes aren’t excessive, and the state has become a hub for trust and finance companies.

Considerations: Cold winters, rural lifestyle, and fewer job opportunities in certain sectors.

Best For: Retirees, agriculture professionals, finance industry workers

Tennessee: Southern Hospitality with Tax Benefits

Quick Facts:

- No income tax ✓

- 9.55% average combined sales tax (second highest)

- Average property tax: 0.48%

- Population: ~7.1 million

The Music City Effect: Nashville has exploded in population, becoming a hub for healthcare, music, and technology. The combination of no income tax, relatively low property taxes, and vibrant culture makes Tennessee attractive.

The Catch: That nearly 10% sales tax means you’ll pay more every time you shop.

Best For: Music industry professionals, healthcare workers, young professionals

Texas: Everything's Bigger, Including the Savings

Quick Facts:

- No income tax ✓

- 8.20% average combined sales tax

- Average property tax: 1.36%

- Population: ~30.5 million

Why Texas Keeps Growing: Texas led the nation with over 85,000 net new residents in recent data. Major tech companies, oil and gas industry presence, and diverse job opportunities make it an economic powerhouse.

Important Consideration: While income tax savings are real, property taxes can be substantial. A $400,000 home might cost $5,440 annually in property taxes.

Best For: Tech workers, energy professionals, families seeking job opportunities and space

Washington: Pacific Northwest, Pacific No-Tax

Quick Facts:

- No income tax on wages ✓

- 7% capital gains tax (over $270,000 annual gains)

- Average property tax: 0.78%

- Population: ~7.9 million

Tech Hub Advantage: Seattle’s tech boom has made Washington a magnet for high earners in the software and technology sectors. Amazon, Microsoft, and countless startups call Washington home.

The Fine Print: While most residents pay no income tax, wealthy investors face the capital gains tax. Sales tax in Seattle can exceed 10% when local rates are included.

Best For: Tech professionals, outdoor enthusiasts, coffee lovers

Wyoming: Wide-Open Spaces, Wide-Open Wallets

Quick Facts:

- No income tax ✓

- 5.36% average combined sales tax

- Average property tax: 0.51%

- Population: ~580,000

Best Overall Tax Climate: Wyoming consistently ranks as one of the most tax-friendly states in America. Low property taxes, no income tax, and minimal sales tax create an ideal environment for keeping your money.

Reality Check: Limited job opportunities, harsh winters, and sparse population aren’t for everyone.

Best For: Remote workers, retirees, ranchers, and those seeking solitude

The Hidden Costs: What They Don't Tell You

Moving to a no-income-tax state isn’t always a financial slam dunk. Here’s what to watch for:

Higher Sales and Property Taxes

States need revenue, and they’ll get it somewhere. Tennessee’s 9.55% sales tax means a $50,000 car costs you an extra $4,775. Texas property taxes on a $500,000 home can exceed $6,800 annually.

Reduced Public Services

Some no-income-tax states invest less per capita in education, infrastructure, and social services. This can mean:

- Larger class sizes in public schools

- More toll roads and fees

- Fewer public transportation options

- Limited social safety nets

Cost of Living Variations

Florida might have no income tax, but try finding affordable housing in Miami or Naples. What you save in taxes might vanish in higher rent or mortgage payments.

Healthcare Access

Rural states like Wyoming and South Dakota have fewer hospitals and specialists. If healthcare access matters to you, research thoroughly before moving.

Who Benefits Most from No-Income-Tax States?

Retirees

With Social Security

and retirement income not subject to state income tax, retirees can stretch

their dollars further. Florida receives nearly 1,000 new retirees daily,

according to Census data.

High Earners

If you’re making

$200,000+, the savings become substantial. A California executive moving to

Nevada could save $20,000+ annually.

Remote Workers

The work-from-home

revolution means you can live anywhere. Why not choose somewhere that doesn’t

tax your paycheque?

Entrepreneurs and Business Owners

Many no-income-tax

states also offer business-friendly regulations and lower corporate taxes,

making them attractive for starting or relocating a business.

Migration Trends: Where Americans Are Moving

The data tells a compelling story. In 2024:

Top Gainers (No-Income-Tax States):

- Florida: +125,551 households

- Texas: +88,216 households

- Tennessee: +30,935 households

Top Losers (High-Tax States):

- California: -144,203 households

- New York: -108,586 households

- Illinois: -45,460 households

Research shows 20 of the 25 most tax-competitive states experienced net inbound migration, while 17 of the 25 least competitive states lost residents. While taxes aren’t the only factor, they clearly influence where Americans choose to live.

Important Considerations Before You Move

Federal Taxes Still Apply

Moving to Texas doesn’t exempt you from federal income tax. You’ll still file Form 1040 and pay your fair share to Uncle Sam.

Residency Requirements Matter

Simply buying a vacation home in Florida doesn’t make you a Florida resident for tax purposes. You’ll need to:

- Spend more than 183 days per year in the state

- Obtain a driver’s license

- Register to vote

- Update your mailing address

- File a declaration of domicile

Your Previous State May Come Calling

High-tax states like California and New York actively audit residents who claim to have moved. Keep detailed records proving your relocation.

Consider the Total Picture

Run the numbers on:

- Current vs. projected income

- Property values and taxes

- Sales tax impact on your lifestyle

- Cost of living differences

- Quality of life factors

The Future: What's Coming Next?

States Considering Elimination

Mississippi and Kentucky are actively phasing out their income taxes. If successful, they could join the no-income-tax club within the next few years.

Competing for Residents

The pandemic accelerated a trend: states competing for residents through tax policy. Recent data shows 39 states changed their tax codes in 2025, with nine specifically cutting income tax rates.

The Flat Tax Movement

Iowa, Louisiana, Mississippi, and North Carolina recently moved to flat tax structures—often a stepping stone toward eventual elimination.

Making the Right Choice for Your Family

Choosing to move to a no-income-tax state is a personal decision that depends on your unique situation. Here’s a simple framework:

Consider Moving If:

- You earn $100,000+ annually

- You’re retiring with substantial income streams

- You work remotely with location flexibility

- You want to maximize savings and investment potential

- The state’s lifestyle matches your preferences

Stay Put If:

- Your current state offers superior schools or services you value

- Job opportunities in your field are limited in no-income-tax states

- Higher sales/property taxes would offset income tax savings

- Family, community, or lifestyle reasons outweigh financial considerations

Actionable Steps to Get Started

Step 1: Calculate Your Potential Savings Use online tax calculators to compare your current tax burden with potential no-income-tax states.

Step 2: Research Beyond Taxes Visit potential states during different seasons. Explore neighbourhoods, schools, and job markets.

Step 3: Crunch All the Numbers Factor in housing costs, insurance, sales tax impact on your spending, and property taxes.

Step 4: Consult Professionals Speak with a tax advisor or CPA familiar with multi-state taxation. The investment could save you thousands in mistakes.

Step 5: Create a Transition Plan If you decide to move, plan your residency establishment carefully to avoid tax complications.

Frequently Asked Questions

Q: Will I pay any state taxes in these states? A: Yes, you’ll likely pay sales tax, property tax, and various fees. Only income tax is eliminated.

Q: Can I work remotely from a no-income-tax state while my employer is elsewhere? A: Usually yes, but your employer may need to withhold taxes for their state in some cases. Consult with HR and a tax professional.

Q: Are there any other states planning to eliminate income tax? A: Mississippi and Kentucky have phased plans to reduce and potentially eliminate their income taxes.

Q: Does Washington’s capital gains tax affect most people? A: No. It only applies to individuals with capital gains exceeding $270,000 annually—affecting less than 1% of residents.

Q: Will moving to a no-income-tax state help me pay off debt faster? A: Potentially. The money saved can be redirected to debt repayment, but only if you’re disciplined about budgeting.

Conclusion: Your Money, Your Choice

Living in a state with no income tax can save you thousands—or even hundreds of thousands—of dollars over your lifetime. For a family earning $100,000 annually, that’s $50,000 over ten years that stays in your pocket rather than going to state

coffers. But remember: taxes are just one piece of the puzzle. The best state for you balances tax savings with quality of life, job opportunities, cost of living, and personal preferences.

As more Americans gain location flexibility through remote work, and as states compete for residents through tax policy, we’re witnessing a fundamental shift in how people think about where to live. The nine states with no income tax offer compelling financial advantages—but they’re not right for everyone. Do your homework, run the numbers, and make the choice that fits your unique situation and goals.

Disclaimer: This article is for informational purposes only and should not be considered financial or tax advice. Tax laws and regulations change frequently. Always consult with a qualified tax professional or financial advisor before making major financial decisions related to relocation or tax planning. While every effort has been made to ensure accuracy based on 2025 data, individual circumstances vary

significantly.

Last Updated: October 2025