Ultimate Inflation-Proof Budgeting Tips: Proven Strategies to Protect Your Finances from Rising Costs in 2025

Table of Contents

Why Inflation-Proof Budgeting Matters Now

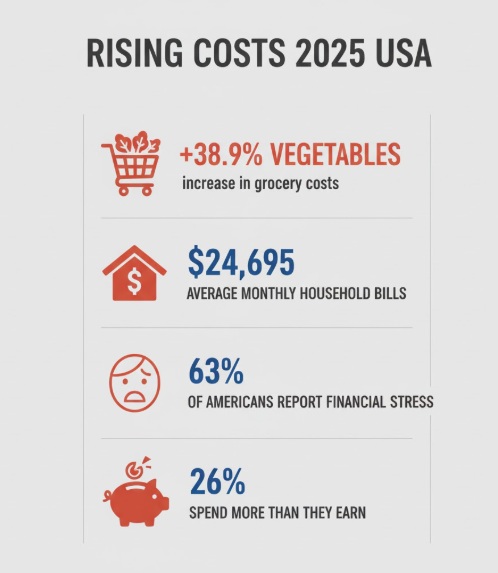

If you’ve noticed your grocery bill climbing or your paycheque not stretching as far as it used to, you’re not alone. In 2025, inflation continues to squeeze American households, with the national inflation rate projected at 2.9% and core inflation holding steady at 3.1%. More concerning, 26% of U.S. households now spend more than they earn, while 77% of adults report their finances have worsened due to inflation.

The impact hits close to home: the median household now spends approximately $24,695 per year on essential bills alone—that’s roughly 31% of income before you even factor in groceries, entertainment, or savings. Recent data shows fresh and dry vegetable prices jumped 38.9% in summer 2025, the steepest increase since 1947. With essential items like eggs, bread, and milk rising faster than wages, it’s clear that traditional budgeting methods aren’t cutting it anymore.

This guide provides research-backed, actionable strategies to help you build an inflation-proof budget that protects your purchasing power and financial stability, no matter what the economy throws your way.

Understanding the Real Impact of Rising Costs

The Burden on American Families

Rising costs affect every household, but the burden isn’t distributed equally. Recent tariffs are projected to raise average household bills by $2,400 annually, with low-income families facing about $1,300 in additional costs while high-income households could see increases up to $5,000. This disparity highlights how inflation disproportionately impacts those with less financial cushion.

The stress is real and measurable. Only 44% of Americans now find bill payments “not at all difficult,” down from 54% in 2021. Additionally, 63% of people report feeling stressed about money—a significant jump that reflects the psychological toll of persistent inflation.

Where Your Money Is Going

Inflation touches virtually every expense category:

- Housing costs continue climbing as both rent and home prices remain elevated

- Transportation expenses increase with higher vehicle prices and insurance rates

- Utility bills rise as energy costs fluctuate

- Grocery spending faces persistent pressure, especially on staples

- Healthcare costs grow faster than general inflation

Understanding these pressure points helps you target your budgeting efforts where they’ll make the biggest difference.

Essential Inflation-Proof Budgeting Strategies

1. Shift to Dynamic Budgeting

Traditional budgets assume stable prices, but that’s no longer realistic. Dynamic budgeting means regularly updating your expense categories to reflect current prices—not what you paid six months ago.

How to implement dynamic budgeting:

- Review your spending categories monthly instead of annually

- Track price changes for your regular purchases

- Adjust allocation percentages as costs shift

- Use budgeting apps that connect to your accounts for real-time updates

- Build flexibility into discretionary categories to absorb unexpected increases

Focus on distinguishing between essential needs and wants. When prices rise across the board, prioritizing necessities becomes crucial for maintaining financial stability.

2. Build and Protect Your Emergency Fund

An emergency fund acts as your financial shock absorber during inflationary periods. Financial experts recommend maintaining three to six months of essential expenses in easily accessible accounts.

Smart emergency fund strategies:

- Keep funds in high-yield savings accounts or money market funds that offer better returns than traditional savings accounts

- Calculate your emergency fund based on current living costs, not outdated estimates

- Resist the temptation to over-hoard cash—excessive savings lose purchasing power to inflation

- Consider a tiered approach: keep immediate needs (1-2 months) in ultra-liquid accounts and longer-term reserves in slightly higher-yield options

- Replenish your fund immediately after any withdrawal

Your emergency fund prevents you from turning to high-interest credit cards or loans when unexpected expenses arise—critical when borrowing costs are high.

3. Prioritize Income Growth Over Expense Cutting Alone

While cutting expenses helps, there’s a limit to how much you can reduce spending on necessities. Growing your income provides more sustainable long-term protection against inflation.

Income-boosting strategies:

- Negotiate raises tied to inflation data: Come prepared with cost-of-living statistics and your contributions when discussing compensation

- Upskill strategically: Invest in certifications or training in high-demand fields that command premium pay

- Develop side income streams: Freelancing, consulting, or small businesses can supplement your primary income

- Explore passive income: Dividend stocks, rental properties, or creating digital products can generate ongoing revenue

- Job switching: In today’s market, changing employers often yields larger raises than staying put

Remember, the goal isn’t just to earn more—it’s to ensure your income keeps pace with or exceeds inflation rates.

4. Invest Smart to Beat Inflation

Keeping all your money in cash means watching its value erode. Strategic investing helps your money grow faster than inflation.

Inflation-resistant investment options:

- Stocks: Historically, the stock market has outpaced inflation over long periods, with average annual returns around 10%

- Treasury Inflation-Protected Securities (TIPS): These government bonds adjust with inflation, protecting your principal

- Real estate: Property values and rental income typically rise with inflation

- Commodities: Assets like gold can serve as inflation hedges, though they’re more volatile

- Dividend-paying equities: Companies that regularly increase dividends can provide growing income streams

Before investing, consider your risk tolerance, time horizon, and financial goals. For major investment decisions, consulting with a certified financial advisor is recommended to ensure strategies align with your personal situation.

5. Tackle High-Interest Debt Aggressively

As the Federal Reserve raises interest rates to combat inflation, borrowing becomes more expensive—especially for variable-rate loans like credit cards and adjustable-rate mortgages.

Debt management priorities:

- Focus on paying down credit card balances first, as rates often exceed 20%

- Consider consolidating high-interest debt through personal loans with fixed rates

- Avoid taking on new variable-rate debt during inflationary periods

- If you have both high-interest debt and low emergency savings, strike a balance—maintain a small emergency fund while aggressively paying down debt

- Look into balance transfer offers with 0% introductory rates, but read the fine terms carefully

Reducing debt frees up cash flow for savings and investments while protecting you from rising interest costs.

6. Combat Lifestyle Creep

Lifestyle creep happens when increased income leads to increased spending rather than increased savings. During inflation, this pattern becomes especially problematic.

Strategies to prevent lifestyle inflation:

- Commit to saving at least 50% of any raise or windfall before increasing discretionary spending

- Practice mindful spending by waiting 24-48 hours before non-essential purchases

- Define your “enough”—what level of comfort genuinely makes you happy versus what’s just keeping up with others

- Automate savings increases whenever you get a raise

- Regularly review subscriptions and recurring expenses to eliminate what you don’t use

Embracing contentment and intentional spending helps you maintain financial stability even as costs rise around you.

Practical Money-Saving Tips for Rising Costs

Reduce Your Grocery Bill

With food costs rising dramatically, grocery savings make a significant impact.

- Plan meals around sales and seasonal produce to take advantage of lower prices

- Buy store brands for staples—they’re often made in the same facilities as name brands

- Use loyalty programs and digital coupons from stores like Kroger, Safeway, and Target

- Buy in bulk for non-perishable items you use regularly, but calculate unit prices carefully

- Reduce food waste by using leftovers creatively and storing food properly

- Grow herbs or vegetables if you have space—even a small container garden saves money

Cut Transportation Costs

Transportation is typically a household’s second-largest expense after housing.

- Maintain your vehicle properly to prevent costly repairs and improve fuel efficiency

- Combine errands to reduce fuel consumption

- Explore carpooling or public transit options for commuting

- Shop around for car insurance annually—rates vary significantly between providers

- Consider a fuel-efficient or electric vehicle if you’re due for a replacement

Lower Utility Bills

Small changes in energy use add up over time.

- Adjust your thermostat by just a few degrees—68°F in winter, 78°F in summer

- Seal air leaks around windows and doors

- Use LED bulbs which use 75% less energy than traditional bulbs

- Unplug devices when not in use to eliminate phantom power drain

- Take advantage of utility company energy audits, often offered free

Update Insurance and Estate Planning

Rising replacement costs and asset values mean your insurance coverage and estate plans may no longer reflect reality.

Important reviews:

- Homeowners or renters insurance: Ensure coverage amounts match current replacement costs

- Auto insurance: Verify your coverage reflects your vehicle’s current value

- Life insurance: Consider whether your policy still provides adequate protection for dependents

- Health insurance: Review plans during open enrolment for the best value

- Estate planning documents: Update asset valuations and beneficiary designations

These reviews protect you from being underinsured when you need coverage most.

Take Control of Your Financial Future

Inflation-proof budgeting isn’t about perfection—it’s about progress. By shifting to dynamic budgeting, building emergency savings, focusing on income growth, investing strategically, managing debt, and resisting lifestyle creep, you create a financial foundation that can weather economic uncertainty.

Remember these key takeaways:

- Review and adjust your budget regularly to reflect current prices

- Maintain an emergency fund in high-yield accounts

- Prioritize growing your income alongside reducing expenses

- Invest in assets that historically outpace inflation

- Pay down high-interest debt aggressively

- Stay mindful about spending and resist lifestyle creep

- Keep insurance and estate planning current

The path to financial stability during inflation requires action today. Choose one strategy from this guide and implement it this week. Small steps compound into significant progress over time.

Disclaimer: This article provides general financial education and should not be considered personalized financial advice. For specific guidance on your financial situation, please consult with a certified financial advisor or qualified professional.